EXPENSE AND ACCOUNTS PAYABLE

BAU created the policies related with expense and accounts payable for the flow of processes to acquire and pay for goods and services. Consequently, it is imperative that all processes prior to reaching the Accounts Payable Manager be complete and accurate. These policies provide for a smooth and timely flow of cash to vendors and employees. Accounts Payable Manager seeks to maintain a satisfactory credit standing with vendors.

The policy numbers in this section range from 5.80 to 5.109. Any new policy added to this section will be assigned a number within this range.

5.80 PAYROLL

| Purpose: | The purpose of this policy is to define requirements for departments, managers and employees to ensure all University employees are paid in a timely and accurate manner and to facilitate payments to payroll vendors for employee benefits and payroll deductions. |

| Scope: | Applies to all staff |

| Responsible Departments: | Human Resources |

| Effective Date: | July 1, 2014 |

| Modification History: | September 1, 2023 |

| Related Policies: | 7.20 Annual Leave Policy (HR Policy) |

| Related Form(s): | – |

POLICY STATEMENTS

This policy is to prepare all University payrolls accurately and timely and ensure University compliance with all rules and regulations pertaining to and/or resulting from payroll operations. To accomplish this mission the HR/ Payroll office must make accurate and timely payments to all persons on the University payrolls, make all statutory deductions and verify that all required reporting procedures are followed in connection with statutory deductions, make all non-statutory deductions and/or reductions and verify that all recordkeeping and reporting procedures are followed, and maintain records and reports required by the University, state, and federal governmental agencies pertaining to personnel paid through the payroll system.

BAU has two different payroll groups: independent contractors (adjunct faculty, student housing security officers, etc.) and staff. Each employee is paid on a bi-weekly pay schedule. The annual pay dates are announced by the HR/Payroll Office in December. The payroll disbursements are processed by APS for regular payday runs. The HR/Payroll office is responsible for monitoring the entries on APS. Manual checks are issued separately in between paydays as necessary.

The President has overall authority to approve payroll changes. The written approval is required as a memo or an email correspondence.

PROCEDURES

Payroll Schedule

All University employees are paid on a bi-weekly pay schedule. The pay periods begin on a Saturday and end on a Friday. Pay day will be the Friday of the week following the pay period ending date. The HR/Payroll office Regular Payroll Processing Schedule is listed below:

1. Monday (Four (4) days before the pay date)

• Review Employee change report.

2. Tuesday (Three (3) days pay date)

• Review and ensure all employee time has been approved and entered.

3. Wednesday (Last day to process payroll)

• Verifying time entry is correct.

• The supervisor’s approvals should be done by Tuesday at 10am.

Pay Cycle: The University’s payroll is processed on a bi-weekly basis. Payroll Processing and Transmittal are done a minimum of 2 days prior to pay date to Friday for the bi-weekly schedule.

Pay and Leave Reporting

Payroll System: The University’s payroll is processed by Automated Payroll Services (APS). The service includes payroll processing (recording), distribution (live and EFT), accrued vacation and sick, and payroll tax returns (including W-2). The Business Systems Analyst of APS provides support to the payroll system if any problems occur. The Director of HR, CFO, President, and Accounting Manager have access to the Payroll System. Reporting access has been granted to the Accounting Manager and CFO.

APS is the official leave record of the employee and must be properly maintained by the HR/Payroll office. Supervisors may choose from one of two options to track and authorize time worked and leave taken by employees. The two choices are:

1. Employee enters time and leave in APS Self Service and a supervisor approves time and leave in Manager Self Service.

2. The employee may submit a leave request form signed and approved by the supervisor to the HR/Payroll department.

Authorization to Pay Employee: Human Resources oversees the salaries of newly hired employees. HR uses a salary table and considers education, experience and training to reach a reasonable salary for the new employee in consultation with the President and approved budget.

Securing Employee records: Employment files are kept in a locked cabinet in the HR office (more recent files are stored electronically).

HR/Payroll office maintains the following files:

✓ Faculty Contracts

✓ W-4’s

✓ Requests for Direct Deposit

✓ Special Assignment Pay Forms

✓ Payroll Advice for Staff as needed with special instructions on pay

The HR/Payroll office remains locked by key access with no public access. Limited staff have access to the HR/Payroll office suite.

Monitoring Payroll Expenditures: President and CFO prepare detailed budget for payroll annually and compare to historic data. Forecast is also prepared on a departmental basis to forecast the future needs for faculty and staff.

Accrued Sick and Vacation: Accrued sick is calculated in APS. Vacation is tracked in the payroll system; and downloaded at the fiscal year by accounting to prepare accrued vacation schedule. The roll-forward for accrued sick and vacation is prepared at the end of the fiscal year.

Summer Session Deferrals: Summer session salaries and benefits are to be allocated between current year expense and prepaid expense based on when the salaries are earned by the faculty. Deferral entries should be made at a minimum at fiscal year-end.

Automated Payroll checks: BAU uses APS to process all regular payments via ACH (direct deposit).

Manual Payroll Checks: Manual checks are generally issued for the following purposes:

✓Termination approved by HR

✓ Late time card submitted by employee

✓ Payroll adjustment of incorrect payment per approved time

✓ Lost or stop payment of checks

Manual check wage, tax and deduction data, is applied to the employee’s pay file at the next regularly scheduled payroll transmittal.

A stock of blank check paper (with control number on the back) is kept in a locked cabinet in the Accounting Manager’s office.

Taxes and Deductions: The Payroll Department is responsible for managing payroll taxes through APS. The HR/Payroll Department cannot give tax advice to any employee. If employees need tax assistance, they should contact the Internal Revenue Service (IRS) or seek their own tax or legal counsel. If an employee does not complete their tax forms or update them as needed, the Payroll Department, following IRS guidelines, must default to the maximum withholding amount.

W-4 Federal Employee’s Withholding Allowance Certificate Guidelines: Employees must complete a W4 form via the APS payroll system.

Changing Tax Information: If employees want to change their withholding, they must do it via their eselfserve.com employee portal.

Voluntary Deductions: In addition to taxes, the HR/Payroll Department also facilitates payroll and other deductions.

Payroll Deductions: HR/Payroll office is responsible for determining employee eligibility and enrollment of retirement, and health care benefits. The use of the cafeteria plan is also facilitated by the HR/Payroll office. HR is also responsible for communicating current and retro deduction amounts to the payroll department in conjunction with these benefits.

Involuntary Deductions: The Payroll Department, upon receipt of legal documentation, is required by law to withhold monies from an employee’s wages to satisfy certain debts.

Examples of involuntary deductions are garnishments, bankruptcies, tax levies, wage assignments, or child support payments. The Payroll Department will notify an employee by email of a debt withholding notice it has received. Employees should also receive prior notification by the issuing court or authorized agency.

BAU utilizes APS’s garnishment service to assist with prioritization and timely disbursements to third-party agencies.

W-2 Distribution

Payroll Services will distribute employees’ W2 Wage and Tax Statements on or before January 31st of each year. Employees have the option of accessing the APS ESelfserve.com portal page and viewing and/or printing their own W2. Employees will need to accept the consent agreement posted in APS before gaining access to their W2 information. Employees that do not consent to the electronic W2 will be mailed their W2 in paper format via the United States Postal Service by January 31st of each year.

Pay Upon Termination

Final checks are automatically calculated through the APS system based on the termination date. Accrued sick and vacation balances are tracked within the APS system through employee requests and supervisor approvals.

The Human Resources Department/Payroll Office reviews the final paycheck for accuracy, including verifying the termination date, accrued sick and vacation payout, and any other deductions or adjustments.

The final paycheck is distributed by Payroll Office, depending on the organization’s standard process.

Distribution can occur via: Direct deposit (with next available payroll for voluntary resignations or within 2 days for involuntary at will terminations.)

DEFINITIONS

Part-time employees: Those working 20 hours per week.

Full-time employees: Those working 40 or more hours per week.

EXCEPTIONS

None

5.81 SALARY ADVANCE

| Purpose: | Provide a policy and procedure for employees to request a salary advance in cases of emergency or personal circumstances. |

| Scope: | Applies to all staff |

| Responsible Departments: | Human Resources |

| Effective Date: | August 1, 2024 |

| Modification History: | |

| Related Policies: | None |

| Related Form(s): | Salary Advance Request Form |

POLICY STATEMENT

Bay Atlantic University (BAU; the University) discourages the use of salary advances. Nevertheless, the University recognizes that, on rare occasions, employees may have an extraordinary personal need to receive a salary advance. In such extraordinary circumstances, the University may consider an eligible employee’s request for a salary advance, subject to the requirements and limitations set forth in this policy.

PROCEDURES

An eligible employee may request a salary advance only in extraordinary emergency or personal circumstances and subject to the requirements, limitations and approval requirements set forth below.

Restrictions and Limitations:

An otherwise eligible employee may not request or receive a salary advance if:

1. The employee is working within a performance improvement plan or

2. The employee has a negative accrual balance for sick leave or vacation leave. The employee has a negative accrual balance for sick leave or vacation leave.

In the event a salary advance is approved, the following will apply:

1. The employee may not request or receive more than one salary advance within a 6-month period;

2. The employee may not request or receive salary advances in consecutive pay periods, even if the consecutive pay periods cross a calendar year;

3. The amount of salary advanced may not exceed one bi-weekly’s net pay

4. Repayment of the amount advanced must be made within four bi-weekly regularly processed paycheck

Request and Approval:

All salary advance requests must be approved in advance by the Office of Human Resources or the President depending on the amount requested.

To initiate a salary advance request, the eligible employee must discuss the reasons for the request with the Office of Human Resources. If the request meets the criteria for a salary advance as set forth in this policy, the Office of Human Resources will instruct the employee to complete the Salary Advance Request Form and submit it to the Office of Human Resources.

1. Employee must sign and date the form acknowledging terms and agreement to repay;

2. Obtain final approval from the Office of Human Resources (under $2,000) and the President (over $2,000) as evidenced by signature on the form, and;

3. Salary advance requests bearing all required approvals and signatures must be received no less than four (4) business days prior to the eligible employee’s next scheduled pay date.

Duration:

The salary advances are valid only during the time of employment. If employment has ended, the remaining salary advance will be deducted from the last distributed check to the employee.

DEFINITIONS

Salary Advance: refers to employees receiving a portion of their pay before their next scheduled payday.

Eligible Employee: full-time faculty members, regular full-time and regular part-time staff members who have been employed with BAU for at least 90 days.

Extraordinary Circumstances: an event or circumstance that is unforeseen, unplanned and unavoidable, that which could not be reasonably anticipated in the normal/routine daily life of the employee requesting the advance.

EXCEPTIONS

None

Salary Advance Request Form5.82 INDEPENDENT CONTRACTORS

| Purpose: | In determination of hiring individuals as consultants/independent contractors, the University’s designation of independent contractor status is governed by the IRS tax code and common law. |

| Scope: | Applies to all staff |

| Responsible Departments: | Human Resources |

| Effective Date: | May 2, 2014 |

| Modification History: | December 15, 2024 |

| Related Policies: | 5.80 Payroll Policy |

| Related Form(s): | Employee/Independent Contractor Classification Checklist |

POLICY STATEMENT

The policy presumes that all individuals who provide a service are employees unless there is evidence to support their classification as an independent contractor and the independent contractor agreement is executed. A department intending to engage a service provider as an independent contractor must follow university approval and contracting procedures before the performance of services.

PROCEDURES

When the University requires special skills for a limited period, such services can be obtained from an independent contractor. However, the person or firm providing the services must satisfy certain requirements as an independent contractor. If the criteria are not met, the individual must be hired as an employee and paid through the university payroll system.

A guest speaker is considered an independent contractor when a fee for services is agreed to prior to engagement. Employees of the University cannot be retained as independent contractors concurrently.

Designation of independent contractor status is governed by the Internal Revenue Service (IRS) tax code and “common law” categories of evidence. It is imperative that a determination of employee or independent contractor be made in accordance with the tax code and “common law” criteria and that each case is fully documented and auditable.

The determination of a service provider’s status as an employee or independent contractor must be made by the Payroll Officer prior to any verbal or written agreements to perform personal or professional services. The Payroll Officer will make the determination of independent contractor or employee based on information provided on the Independent Contractor Checklist. If a determination is made that a service provider is an independent contractor; the adjunct independent contractor agreement shall be executed. If the university department engages an individual as an independent contractor, the department must document the necessary evidence to support this position and obtain an executed adjunct independent contractor agreement.

Determination of independent contractor status must be made by the Payroll Officer prior to any agreement to perform personal or professional services. Written agreements are required for all services provided to the university to ensure that verbal “understandings” do not become an agreement/binding until approved and as required herein an independent contractor agreement is signed.

The requesting department must complete the Employee/Independent Contractor Classification Checklist. The form is designed to obtain important information to assist the Payroll Office in determining whether a service provider is an independent contractor or an employee. Accurate answers should be obtained through interviews with the potential service provider and based on the requirements of the services to be completed. A proposed contract should be developed as backup documentation for the checklist. The proposed contract should not contain any signatures at this time.

It is important to note that the Employee/Independent Contractor Classification Checklist only provides indicators, and each determination needs to be evaluated within the context of each unique situation by the Payroll Officer, therefore accurate and complete information and proposed documentation is necessary.

The Payroll Office reviews the checklist and the proposed contract and completes a determination worksheet. If necessary, the Payroll Officer will contact the requesting department for additional information and discuss the results of the determination. Upon final determination, the Payroll Office will sign and indicate the determination on the checklist.

DEFINITIONS

Employee: For the purposes of this policy, an employee is a person who is hired through the Department of Human Resources and is paid under a W-2 (and not a 1099).

Honorarium: An honorarium is a payment made to an independent contractor for an academic activity or service for which fees are not traditionally charged such as payments granted in recognition of an academic activity conducted for the benefit of the University’s mission, such as lecturing, reviewing promotion, conducting limited research, attending meetings, symposia or seminars, or otherwise sharing knowledge. Readings and performances are included in academic activities, so long as the activity is open to the public and/or students without charge. Honorariums are taxable as income to the recipient.

Independent contractor: For purposes of this policy, an independent contractor is an individual who provides services to Bay Atlantic University and is not an employee: a person who should be paid under a 1099 (and not a W-2). Specifically, it is a person who: (a) is engaged in an independently established profession or business of providing the services (b) provides a service to the University that is not normally provided by university employees (c) is free from the University’s control or direction when providing these services. The criteria for determining whether a worker is an independent contractor are previously discussed.

IRS Form 199 MISC: An Internal Revenue Service form used to report non-employee compensations and other miscellaneous income. IRS Form W-9 Request for Taxpayer Identification Number and Certification: An Internal Revenue Service form used to provide the university with a taxpayer identification number –social security number or employer identification number. A W-9 is required to be on file for any vendor or individual being paid by the College for services rendered as an independent contractor.

IRS “Common Law” Categories of Evidence – To determine whether an individual is an employee or an independent contractor under the “common law” categories of evidence, the relationship of the worker and the business must be examined. All information that provides evidence of the degree of control and the degree of independence must be considered to determine classification as an independent contractor or employee. According to the IRS, factors that provide evidence of control and independence fall into three categories: behavioral control, financial control, and type of relationship.

Contract: A legal agreement that establishes the rights and duties of the contracting parties and constitutes a relationship giving each the right to seek remedy for the breach of those duties.

Limited engagement – A category of service, provided by an independent contractor, that occurs only one time, or one time per year, for a fee of $10,000 or less.

EXCEPTIONS

None

Employee Independent Contractor Classification Checklist5.83 PURCHASES AND PROCUREMENT

| Purpose: | To outline the procurement practices for purchasing goods and services at the University and to address competitive bidding and supplier selection, approval and issuance of purchasing transactions, purchasing methods, authorizations, required documentation, and ethical practices. |

| Scope: | All departments of the University |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | July 1, 2019, December 1, 2024 |

| Related Policies: | 5.20 Code of Ethics Policy, 5.21 Conflict of Interest Policy, 5.84 Invoice Approval and Processing Policy, 5.85 Cash Disbursement Policy |

| Related Form(s): | Purchase Order Form, Catering Request Form, Non-Competitive Justification Form |

POLICY STATEMENT

With University’s diverse and decentralized operations, it is appropriate to establish an overarching policy to guide procurement transactions. Responsible stewardship in the expenditure of University funds entails the proper combination of price, quality, and reliability. This requires that employees involved at every step of the process take full responsibility for understanding the University’s policies and procedures regarding purchasing and vendor relations. This policy is meant to support the need to get products and services in a timely and cost-effective manner, while ensuring appropriate business processes are followed. This policy is meant to provide guidance to end users making purchases on behalf of the University.

Ethical Standards

It is the policy of the University that its employees conduct the affairs of the University in accordance with the highest ethical, legal, and moral standards. An employee must not be in a position to make a decision for the University if his or her personal, professional, or economic interests (or those of his or her immediate and extended family members) may be directly influenced or affected by the outcome.

University employees shall not solicit or accept, directly or indirectly, anything of material economic value as a gift (as defined in the Conflict of Interest Policy), gratuity, favor, entertainment or loan, which is or appears to be designed to influence official conduct in any manner, particularly from a person who is seeking to obtain contractual or other business or financial arrangements with the University.

Purchasing decisions should be made free from any actual, potential, or perceived conflicts of interest. For further information please refer to Conflicts of Interest Policy. Purchasing decisions should be made with integrity and objectivity. For more detailed information, see the Code of Ethics Policy.

To protect our suppliers’ rights to confidentiality, and the University’s interests, competing suppliers must not be told the prices, terms, or conditions quoted by other suppliers.

PROCEDURES

Purchase orders are required for the purchase of office supplies, goods, electronic equipment, software and hardware purchases, furniture, books, educational materials, promotional materials, repairs and maintenance, and such. A Purchase Order Form is submitted by the employee, which is first approved by the supervisor, and then by the CFO if the purchase order is included in the budget, or by the President if the order is not in the budget. The Purchase Officer follows the Invoice Approval and Processing Policy after the approvals are received.

Catering Request Form is required for all events that will serve foods and drink, which is submitted by the employee, approved by the supervisor, and then by the CFO if event type is included in the budget, or by the President if the event type is not in the budget. The Purchase Officer follows the Invoice Approval and Processing Policy after the approvals are received.

Competitive Bidding Requirements

For purchases less than or equal to $9,999, Purchasing Office should use good judgment in identifying potential suppliers. The Purchasing Office may use trusted vendors and negotiate discounts.

Purchases between $10,000 and $24,999 require Purchasing Office to obtain an adequate number of quotations (at least two) from qualified sources.

Purchases of $25,000 or above require the Purchasing Office to obtain a minimum of two bids (three preferred) from qualified sources. The Purchasing Office will provide a summary of the bid results for the CFO’s review and evaluation. If there are limited sources of supply, purchases may be approved without two or more bids, but the department must justify the purchase with a Non –Competitive Justification Form.

Construction and renovation projects costing $1,000,000 or more must be approved by the Finance Committee of the Board of Trustees, and either the Executive Committee or full Board of Trustees.

Consistent with the requirements of 2 CFR 200, requirements may differ in the use of competitive proposal procedures for qualifications-based procurement of architectural/engineering (A/E) professional services whereby competitors’ qualifications are evaluated, and the most qualified competitor is selected, is allowed subject to negotiation of fair and reasonable compensation.

Non-Competitive Purchases

Certain purchases are exempt from the above competitive bid requirements. Exempt purchases are those that meet at least one of the following conditions:

- Items sold through manufacturer only; no other comparable unit available.

- Used or demonstration equipment available at a lower-than-new cost. Must match existing piece of equipment and be available only from the same source of the original equipment.

- Repair/Maintenance service requires expertise in operations on unit.

- Necessary parts unavailable from any source except original equipment manufacturer or their designated servicing dealer.

- Service(s) provided by the vendor are unique.

- Preferred Suppliers available, but do not meet end user requirements.

- Purchases for certain professional services as categorized by the Purchasing Department and approved by a University officer (University officers are identified in the University’s Bylaws).

Diverse and Inclusive Purchasing

The University strives to promote the development of business relationships with diverse and local suppliers. The University is committed to developing mutually beneficial relationships with small, minority owned, women-owned, disadvantaged, veteran-owned, HUB zone, and local business enterprises.

Emergency Purchasing

When an emergency situation occurs, an authorized Purchasing Office representative may make a commitment to a vendor without a formal purchase order. Such transactions would include, for example, an unanticipated and sudden life-threatening or catastrophic event.

DEFINITIONS

Trusted Vendors: Vendors that University has been using for years which offer good quality service, respond to urgent needs without adding extra charges to the University, has proven to be offering

competitive prices over the years.

Bid or Bidding: is a process performed by a “buyer” used to determine the cost or value a product or service based on the context of the situation.

EXCEPTIONS

None

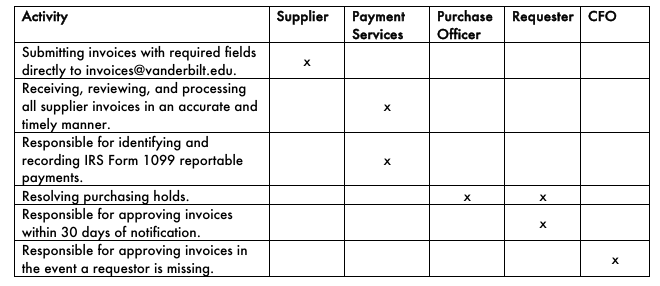

Purchase Order Form5.84 INVOICE APPROVAL AND PROCESSING

| Purpose: | |

| Scope: | The receipt, review, and processing of all supplier invoices authorized by a BAU purchase order. |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | July 1, 2022 |

| Related Policies: | 5.83 Purchases and Procurement Policy |

| Related Form(s): | – |

POLICY STATEMENT

This policy defines the requirements for receiving, processing, approving, and paying supplier invoices for purchase order-based transactions including ensuring invoices are properly prepared, reviewed and recorded. All invoices must be approved by the CFO, if budgeted, or the President, if not budgeted. Approved invoices will be paid within 45 days of receipt or at the earliest convenience. Accounts Payable Manager enters bills to the accounting system.

PROCEDURES

Acceptable Invoices:

The university will not accept supplier statements or copies of purchase orders as substitutions for a supplier invoice.

The university requires all supplier invoices received via the [email protected] email address to contain the following elements legibly printed on the invoice:

- Supplier name and address and references Bay Atlantic University;

- Unique invoice number;

- Invoice date;

- Purchase order number;

- Description of goods or services provided to the university;

- Invoice amount;

- The university will return any invoice not meeting these specifications to the supplier.

The university will only accept invoices in portrait orientation in .TIF; .TIFF; .PNG; .JPG; .DOC; .DOCX and .PDF file formats.

BAU will accept multiple invoices attached to a single email; however, each attachment must contain only one, unique invoice. The university will return emails to suppliers that do not conform to this policy.

Payment Services will enter invoice numbers exactly as referenced on the supplier’s invoice.

Payment Services and Payment Terms:

The standard payment terms are 45 days from invoice date and only the Chief Financial Officer (CFO) and the President are authorized to grant exceptions to payment terms.

The Accounts Payable Manager will capture early payment discounts within the terms offered by the supplier.

Copies of all invoices paid will be filed in the finance department.

Once checks have been separated from paid invoices, the invoice, written check request, and check stub are filed by vendor chronologically, i.e. the most recent invoice placed at the top of the file.

The CFO is responsible for the financial stewardship ensuring that all transactions are recorded accurately and are in compliance with applicable university policies.

DEFINITIONS

Invoice: A document issued by a seller to the buyer that indicates the quantities and costs of the products or services provider by the seller.

Purchase Order (PO): A purchase order is a document that authorizes a purchase transaction. This document is issued from a buyer to a seller and when accepted by the seller, the purchase order becomes a legally-binding contract. A purchase order contains the descriptions, quantities, prices, discounts, payment terms, date of performance or shipment, other associated terms and conditions, and identifies a specific seller.

Supplier Statement: A supplier statement is a detailed report sent by a seller to a customer, showing billings to and payments from the customer during a specific time-period, resulting in an ending balance.

Supplier: Individual, group or entity providing services to the university or seeking payment from the university. All policies that meet the above criteria should be included in the electronic university policy library and are governed by this policy.

EXCEPTIONS

None

5.85 CASH DISBURSEMENTS

| Purpose: | To provide cash disbursement procedures via different modalities |

| Scope: | All cash disbursement procedures |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | June 1, 2023 |

| Related Policies: | 5.83 Purchases and Procurement Policy, 5.84 Invoice Approval and Processing, 5.88 Employee Allowable Expenses and Expense Reimbursement Policy, 5.89 Guest Travel Policy, 5.90 Board Travel Policy, 5.80 Payroll Policy |

| Related Form(s): | – |

POLICY STATEMENT

Disbursements are used to facilitate the purchase of goods and services. These payments must conform to other BAU fiscal policies. This policy aims to provide cash disbursement procedures to ensure that funds are disbursed only for valid business purposes after approvals by authorized persons and in compliance with applicable donor, sponsor, or regulatory requirements. It also establishes procedures for the disbursement of funds via different modalities.

The procurement system includes the formal requisition/purchasing system, procurement cards (credit cards), and requests for funds. Travel reimbursement vouchers, the procedures of which are described in detail in 5.88 Employee Allowable Expenses and Expense Reimbursement Policy, 5.89 Guest Travel Policy, and 5.90 Board Travel Policy, constitute a request for a check to the traveler. The payment of employees for services rendered is a cash disbursement.

PROCEDURES

Procedures for payments – accounts payable – checks and electronic funds payment

1. Purchase orders, requests for funds, and travel vouchers will necessitate payment to be made to the vendor. Upon the appropriate authorization to pay in accordance with related policies, adequate budget, an indication of receipt, and an invoice, the Accounts Payable Manager specialists will assemble documentation to support the disbursement of funds.

2. The accounting manager will review documentation supporting all expenditures to ensure they contain evidence to support adequate authorization, receipt, and University purpose. In addition, the accounting manager will ensure that disbursements are in accordance with applicable rules and regulations. Review of grant expenditures must be routed through a grants accountant to ensure compliance with grantor restrictions.

The form of the disbursement to the vendor will be determined by the vendor.

1. Vendors can elect to receive payments either by check, credit card, or by electronic funds transfers directly to their bank account. A vendor will be considered a vendor to be paid by check if they have not indicated they will accept credit card, and they do not have the appropriate paperwork for an EFT payment completed and returned to the Finance Office.

2. University’s accounting program provides for the ability to do a check run that sequentially numbers checks and electronic remittances. Accounting staff know by check numbers and the electronic payment that follow different numbering standards which vendor was paid by which method. The checks and/or electronic payment files are created from the vendor profile that the Accounts Payable Manager do not have the access to alter.

3. Electronic payment (ACH) instructions for vendors are reviewed and input into the computer system by the Accounts Payable Manager.

4. BAU utilizes three-part check stock. The check document is the top portion, the detail which accompanies the check is under it, and at the bottom is the check stub which will be stored separately. Copy of the signed check is attached to the invoice for filing. Void checks are marked VOID. The original check is retained in the VOID check file.

5. Accounts Payable Manager will print the checks and take the checks with the approved backup to the authorized signers. The Accounts Payable Manager will forward the electronic payments file to the bank through the bank’s secure interface.

6. Once checks are signed, the accountant removes the attached documentation for filing and places the check in envelope for mailing. Checks for staff reimbursements or purchases are released to the approved staff member. Payroll checks prepared by the payroll service are direct deposited to employee’s accounts.

7. A check log is kept on the accounting program. Checks are printed on blank stock only in the business office on a specific printer. Unused blank check stock is kept in a fireproof safe.

8. Returned checks are logged by the accounts payable staff. The Accounts Payable Manager determines the appropriate action to disburse payment to the vendor.

Procedures for payments – payroll – checks and direct deposit

1. All employees are required to receive payment for their services via direct deposit of funds to a bank account. Checks are provided only if there is a problem with bank services.

2. New hires fill out a direct deposit form electronically provided by the HR. Employees have access to APS (HR Software) to change their direct deposit accounts saved in the system with the approval of the HR.

3. Direct deposit forms include the name of the individual on the official records of the University, the individual’s staff ID, name on the account, and electronic signature. The University does require that the name of the employee be included as one of the names on the bank account.

4. The human resource and payroll module provides for only the human resources staff to have access to create new employee and job records.

5. The supervisor of the employee approves the time sheets on the software prior to payment to ensure accurate payment. Employees are not paid without an approved timesheet. The payroll officer verifies the data entry and completes the payroll authorization. The software automatically prepares direct deposits.

Procedures for payments – credit card

1. Supporting documentation is attached to any Credit Card use (credit card slips, itemized bills, credit card statements) and then it is forwarded to the Accounts Payable Manager. The Accounts Payable Manager vouches the documentation and matches the supporting documentation to downloaded transaction data. Data is downloaded once per week and transactions that do not have documentation to support them are identified and the appropriate cardholder is asked to provide said support. Cardholders are responsible for all charges to the credit card, and if support is not provided, appropriate measures are taken.

2. Authorized and reviewed voucher packets from vendors that accept credit card payments will be reviewed for receipt and authorization by the Accounts Payable Manager. If the documentation from the regular accounts payable process is in order, the Accounts Payable Manager can make payment via credit card.

3. The CFO reviews transactional data on a weekly and monthly basis. Payment is debited directly from the University’s bank account and the CFO/President verifies and approves the payment.

Electronic funds transfers as a payment mechanism- direct debit to University bank

Direct debits to the bank account will occur as follows:

a. Mandates currently require and/or highly encourage the payment of certain taxes and claims through vendor/agency specific websites that directly debit the University’s bank account. Examples include but are not limited to federal withholding taxes, unemployment reimbursements, and sales tax payments.

b. The University merchant service agreements as authorized by the president directly debits credit card fee and equipment charges to the University’s bank account.

c. The Accounts Payable Manager and the CFO are authorized to perform a wire to pay the University credit cards.

d. The University’s ACH agreement directly debits the main banking account for both payroll and accounts payable ACH/direct deposits. All staff that are authorized to perform ACHs are indicated in the ACH banking agreement. The bank allows the University to update changes in personnel without redoing a new ACH agreement. The University is expected to update changes within the online system for electronic banking where ACHs are performed. The President has administrative rights to add users, alter their access to the bank’s secure interface, and to reset passwords within this system.

e. Direct payment to vendors for goods or services may be directly debited to the University account as long as the arrangement is authorized by the CFO and the payment has already been vouched through the normal accounts payable process.

Electronic funds transfers between University accounts

1. Transfers of funds to manage cash between University bank accounts are not considered cash disbursements but are electronic transfers of funds between bank accounts. The information is not included in expense reporting totals but is included in the support for the bank reconciliation.

2. Both the CFO and the Accounts Payable Manager are authorized to transfer funds from the University’s primary bank account to other University accounts or to any vendor. Both are required to execute and authorize an electronic wire under the primary banking agreement. A copy of the executed online confirmation and transfer sheet is forwarded to the accounting manager to record in the accounting records.

3. The University’s primary bank directly mails written confirmation of all wire transactions directly to the accounting manager who is the bank reconciler. The University’s primary bank maintains administrative authority within its wire transfer system. Wire transfers require a two-party authorization. Written confirmation is always mailed by the bank directly to the accounting manager (and the President) who performs the bank reconciliation.

4. The CFO is authorized to approve an ACH/check payment to be made through the normal accounts payable process to fund the transfer of funds between University bank accounts at different banking institutions. This allows for cash management so that the depository accounts held in secondary banks can get the money transferred into the University’s primary checking account.

5. The CFO is authorized to assign one accounting staff member to have access to the University’s PayPal and Zelle accounts. The funds in the Paypal account is automatically transferred to the main University account weekly. Zelle account is directly connected to a University bank account and the accounting manager transfers funds to the main University account weekly. The bank reconciler will verify a printout of activity monthly to make sure all transactions are proper and recorded.

DEFINITIONS

–

EXCEPTIONS

None

5.86 PETTY CASH

| Purpose: | The purpose of this policy is to establish guidelines for the management and use of petty cash funds within the university. |

| Scope: | This policy applies to all departments and administrative units of the university that maintain or utilize petty cash funds. |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | – |

| Related Policies: | 5.27 Cash Security Policy, 5.87 Loss of Money and Securities Policy |

| Related Form(s): | Petty Cash Custodial Agreement, Petty Cash Request Form, Petty Cash Log |

POLICY STATEMENT

The university is committed to maintaining strict internal controls over petty cash funds to ensure their proper use for minor and incidental expenses. This policy provides the guidelines on establishing, managing, and terminating petty cash funds. This policy ensures that petty cash is used appropriately, accounted for accurately, and safeguarded against misuse or loss. It is intended to help faculty and staff to understand the University’s rules on the use of petty cash funds; properly record and report transactions processed through petty cash funds; and, know the responsibilities of employees involved in the use and management of petty cash funds.

Petty cash is not to be used for personal expenses, advances, or any purpose that violates university policies or applicable regulations.

Records and receipts must be maintained to support all expenditures incurred or reimbursed from the petty cash advance. The bills or invoices submitted for reimbursement must show evidence of being paid. If a receipt was not issued or does not show evidence of being paid because payment was made by check, include the canceled check. The custodian should deny the request if the original receipts or attachments required by policy are unavailable, or if the request is not reimbursable under University policy. If a request to replenish the petty cash advance is refused due to lack of support or if the expenditure is disallowable per University policy, the custodian and the department associated with the funding account assumes responsibility for the use of the funds.

The use of petty cash funds is subject to University audit, and therefore the custodian is responsible for the proper disbursement of the funds, receipting, and record keeping according to University requirements. In addition, the custodian is responsible for maintaining an activity ledger of all receipts and disbursements of petty cash.

Petty cash will be kept in a lockbox that is locked in a cabinet. Keys to the cash box and cabinet should be kept on the custodian’s person.

PROCEDURES

Establishment of Petty Cash Fund:

• Only the Finance Office can use the petty cash. If approved by the CFO or the President, a specific unit may be allowed to use petty cash on occasional purposes, and a separate petty cash fund can be established with the following information and filling the Petty Cash Request Form.

o The department making the request

o The amount requested

o Specific reasons for the request

o The method of storing and safeguarding the petty cash fund

• Once approved, the custodian designated by the requesting department will be contacted by the Accounts Payable Manager and sign the Petty Cash Custodial Agreement. Approved funds will be disbursed by the Finance Office.

Usage of Petty Cash:

• Petty cash may only be used for minor expenses such as office supplies, postage, or other incidental costs.

• All employee travel advances and reimbursements must be processed through AP workflow. Per diem allowances are not reimbursed through the petty cash fund.

• Transactions must be supported by original receipts that clearly state the date, amount, and purpose of the expense.

• Individual transactions should not exceed the pre-approved limit, typically $500. If a higher amount needs to be paid, the President’s approval is required.

• Individuals who receive and disburse the petty cash amount are required to fill the Petty Cash Request Form and sign with any evidence of payment (invoice, check, ticket, etc.).

Safeguarding Petty Cash:

• The custodian must store petty cash in a secure, locked location accessible only to authorized personnel.

• The fund should be regularly counted and reconciled to ensure accuracy. Replenishment of Petty Cash:

• To replenish the petty cash fund, the custodian must submit all receipts along with a reconciliation report to the Finance Office.

• The Finance Office will review and approve the reimbursement request before issuing additional funds.

Reconciliation and Record-Keeping:

• Petty cash funds must be reconciled at least monthly or whenever replenishment is requested.

• The custodian must maintain detailed records of all transactions, including receipts, reconciliation reports, and approved reimbursement requests.

• The designated Finance Office staff is required to keep the petty cash log on a daily basis.

Closure of Petty Cash Fund:

• Remaining cash must be returned to the Finance Office, and a final reconciliation report must be submitted.

DEFINITIONS

Petty Cash Fund: A small amount of cash kept on hand for minor, incidental, and immediate expenses that cannot be conveniently paid through other means.

Custodian: The designated employee responsible for managing and safeguarding the petty cash fund.

Replenishment: The process of restoring the petty cash fund to its original amount by submitting receipts and a reimbursement request.

EXCEPTIONS

None

Petty Cash Forms5.87 LOSS OF MONEY AND SECURITIES

| Purpose: | To ensure that losses are reported on a timely basis. |

| Scope: | Guidance on reporting losses of money and securities |

| Responsible Departments: | Finance Office, Facilities Office |

| Effective Date: | July 1, 2024 |

| Modification History: | 5.27 Cash Security Policy |

| Related Policies: | – |

| Related Form(s): | Loss of Money and Securities Form |

POLICY STATEMENT

All losses of University money and securities, property or equipment owned by the University, rented or leased by or for the University including those for which the University has legally accepted custody and responsibility must be reported regardless of the cause and amount.

PROCEDURES

Categories of Losses to Be Reported – All losses resulting from or involving:

• Actual or suspected theft, burglary or robbery

• Errors in record-keeping or making change where theft is not suspected

• Acceptance of invalid of non-redeemable paper include post office or express money orders, and forged or altered checks, drafts, promissory notes, etc.

• Acceptance of counterfeit U.S. paper currency

Reporting Requirements

• The theft or disappearance of money or securities owned by the University, or for which the University has legally accepted custody and responsibility, is to be reported immediately to the CFO by completing Loss of Money and Securities Form.

• The Form is to be signed by the Finance Office staff who is charged with the care, custody or control of the money or securities, which was either stolen or disappeared. The form should be forwarded to the CFO within 24 hours after discovery of the loss.

• Any errors of $50 or more should be reported to an administrative supervisor or fiscal officer.

• All losses affecting credit deposits must be reported on the Cash Receipts Report (CRR) regardless of the cause of amount of loss.

• Attempted theft, burglary or robbery must be reported immediately to the supervisor and the CFO even though no loss actually occurred.

Additional Reporting Requirements for Counterfeit Currency

• If counterfeit currency is discovered while in the possession of the University, it must be reported and surrendered to the U.S. Secret Service by the discoverer. If a credit deposit is involved, the resulting shortage must be reported on the CRR.

• If counterfeit currency is discovered by the bank and reported as a reduction to a deposit, the Accounts Receivable staff must file the reports required above and make the necessary adjustments to the deposit. The bank will notify the U.S. Secret Service and surrender the counterfeit currency directly.

Making Statements Regarding Losses – Employees are not to make any statement regarding a loss to the press or anyone other than a member of the:

• CFO

• President

DEFINITIONS

–

EXCEPTIONS

None

Loss of Money and Securities Form5.88 EMPLOYEE ALLOWABLE EXPENSES AND EXPENSE REIMBURSEMENTS

| Purpose: | To ensure that employees who incur valid business expenses are reimbursed in a fair and equitable manner |

| Scope: | Any member of the University Community who initiates, processes, approves, or records financial transactions that involve University funds |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | November 17, 2021 |

| Related Policies: | 5.86 Petty Cash Policy |

| Related Form(s): | Reimbursement Request Form, Travel Advance/Expense Request Form, Missing/Inadequate Documentation Report |

POLICY STATEMENT

Bay Atlantic University reimburses employees for necessary and reasonable approved expenses they incur in the conduct of University business. BAU employees incur various types of expenses as they perform tasks and duties that support the operations of the institution and further its missions. This policy is to ensure that employees who incur valid business expenses are reimbursed in a fair and equitable manner; that business expenses are reported, recorded, and reimbursed in a consistent manner throughout the University; and that the University complies with all applicable federal, state, and local rules and regulations.

The reimbursement should first be approved by the supervisor of the employee and then by the CFO if the expense item is budgeted, or by the President, if it is not.

Criteria for Determining a Permissible Expense

In order to be paid directly by the University or reimbursed to an individual, a business expense mut be:

• Necessary to perform a valid business purpose fulfilling the mission of the University; and

• Reasonable in that the expense is not extreme or excessive, and reflects a prudent decision to incur the expense; and

• Appropriate in that the expense is suitable and fitting in the context of the valid business purpose. The following questions should be considered when determining the appropriateness of costs:

• Could the cost be comfortably defended under public scrutiny?

• Would you be confident if the cost was selected for audit?

• Would you be comfortable reading about it in the newspaper?

• Would you be comfortable explaining to a donor that their donation was used this way?

• Does the supporting documentation align with the requirements of the Policy?

Employees who use personal funds for expenses for which they will seek reimbursement from the University are advised to refer to the policy before they incur any expenses to avoid incurring costs that may not be reimbursed.

Individuals who approve or process requests for reimbursement are required to know and understand the policy, to ensure that University funds are used appropriately and to facilitate compliance with applicable University and government requirements.

Non-Permissible Expenses

Non-Permissible Expenses refer to those expenses that are not related to any activity of the University, are not required in carrying out an individual’s task or responsibility at work, or do not benefit the University. Non-Permissible Expenses include, but are not limited to, the following:

• Childcare / pet care

• Clothing and toiletry items for personal use

• Personal membership and club fees, such as airline clubs and personal Amazon prime account

• Expedited Traveler Screening programs such as TSA PreCheck, CLEAR, Global Entry or SENTRI or NEXUS

• Frequent flyer and other similar awards for hotel and car rentals

• Grooming services (haircuts and shoeshines)

• Gym and recreational fees, including massages and saunas

• In-room movies

• Traffic violation penalties

• Upgrades (air, hotel, car, etc.) and first-class airfare when traveling on University business

• Expenses that will be reimbursed from another source

• Any fraudulent expense

• Spousal/partner travel

• Voluntary charitable contributions

• Any expense prohibited by law (e.g., University funds cannot be used for payments or donations to political organizations or candidates)

In addition to the above expenses, these items are never reimbursable or allowable:

• Drugs or Illegal Substances

• Firearms and ammunition

• Hazardous Materials

• Political Contributions

• Expenses made through third party payment sites such as Venmo, Zelle, PayPal (Personal Payment), Auction Sites

PROCEDURES

Reimbursement of business expenses may be requested through Accounts Payable by submitting a fully completed, adequately documented, and appropriately approved Reimbursement Request Form. The reimbursement should first be approved by the supervisor of the employee and then by the CFO if the expense item is budgeted, or by the President, if it is not.

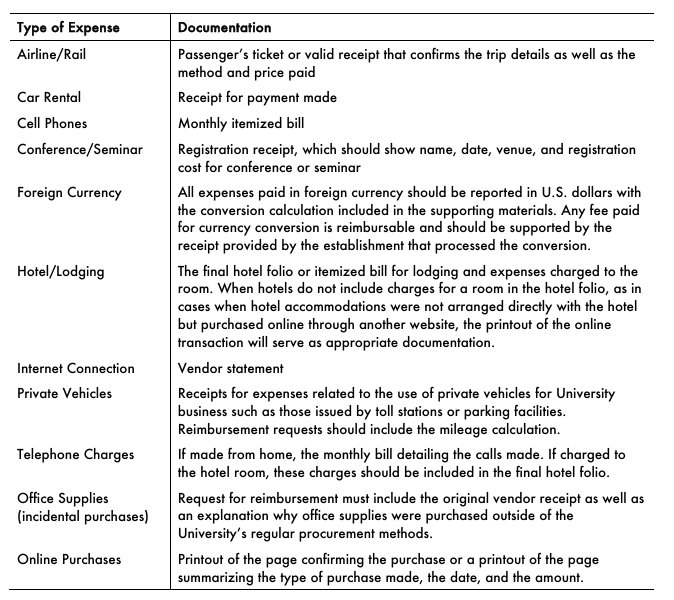

Documentation Requirements

In order to be considered an accountable plan by the IRS, expenses incurred by employees or independent contractors must have a business connection, the individual must adequately account to the University for these expenses within a reasonable time (60 days) and the individual must return an excess reimbursement or allowance within a reasonable time (60 days). If all three conditions are met, the reimbursement can be excluded from the individual’s taxable income.

The University prefers to have receipts for all expenses submitted for reimbursement. It will, however, reimburse approved non-meal expenses under $50 without receipts. Expenses related to meals, regardless of the amount, require receipts to be reimbursed unless a per diem is requested.

Appropriate documentation for common business expenses is shown below:

Meals (Non-Travel)/Catering Related to Business Meetings or Events

Receipts: The best documentation for expenses related to meals and catering are original, itemized receipts showing a detailed list of food and beverages purchased. Restaurant tabs and credit card slips by themselves are not the best documentation for the reason that they cannot validate the types of expenses incurred. However, the University is cognizant of cases and circumstances where itemized receipts may not be available or obtainable. Some establishments may issue receipts that only provide a summary of expenses with the total charges; others issue only a customer’s portion of a tab that indicates total charges. In such cases, the University will deem “appropriate” documentation those “summary receipts” and tabs; and in cases where receipts are not available at all, those credit card slips generated when payment was made using a credit card.

Business Purpose: The substantiation of the meal itself as having a business purpose is needed. When reporting expenses, include the reason for the business meal, the names of individuals present, and their affiliations.

Gratuities: Gratuities for meals are deemed part of the meal cost and will be reimbursed by the University provided these are reasonable (do not exceed 20% of total meal cost).

Meals During Travel

Receipts: Individuals who travel on University business are reimbursed for meal expenses they incur in two ways: according to actual, substantiated costs, or at an established “per diem” rate. Travelers cannot switch between these two methods on one trip; the method travelers choose applies to all meal expenses incurred throughout a trip.

a. Based on actual substantiated costs when opting to be reimbursed based on the actual costs of each meal, travelers are required to provide detailed receipts or other appropriate documentation for all meals taken throughout the trip.

b. Based on “per diem” rate. The alternative to keeping receipts and other appropriate documentation for each meal during travel is the “per diem,” or being reimbursed at an amount set as meal and incidental expense allowance for each day of travel. Per diem only applies when overnight travel is involved. It is permissible to utilize the combined meals and incidental expense rate when reimbursing based on the per diem method. Per diem rates for meals and incidental expenses are outlined as follows:

• The General Services Administration sets rates for travel within the 48 contiguous states. These rates can be found at http://www.gsa.gov/portal/content/104877.

• The Department of Defense sets rates for Alaska, Hawaii and U.S. Territories and Possessions. These rates can be found at http://www.defensetravel.dod.mil/site/perdiemCalc.cfm.

• The State Department sets rates for International Travel. These rates can be found at http://www.state.gov/travel.

When reporting meal and incidental expenses for reimbursement based on the per diem rate, employees are required by the U.S. General Services Administration to prorate the meal and incidental expense allowance for the first and last day of the trip. The first and last calendar day of travel is calculated at 75 % of the locale’s per diem.

Business Purpose: Meals taken by employees during business travel are deemed “business meals.” The business purpose of the trip also serves as the business purpose for the meals.

Missing or Inadequate Documentation

When the original receipts of expenses for which employees are requesting reimbursement have been lost or cannot be obtained, they need to provide other documentation that may support the validity of their expenses. When submitting documentation in lieu of original receipts, they must complete a Missing/Inadequate Documentation Report, explaining on the Report why original receipts are not available and indicating other documentation that they provide to support their request to be reimbursed by the University for the expenses they are reporting. The “Missing/Inadequate Documentation Report” is intended to respond to valid, unavoidable instances where original receipts or appropriate documentation cannot be obtained or were lost. The Report is not required for the following:

• expenses under $50 (except meal expenses)

• business meal expenses incurred in establishments that do not issue itemized receipts or for which original itemized receipts have been lost

• business travel meal expenses when the traveler has opted for the “per diem” method of reimbursement

Timing:

Expenses incurred in the conduct of University business generally should be accounted for within 60 days after the date of expenditure, completion of event, or (when expenses are related to overnight travel) return from a trip in accordance with IRS regulations.

Cash Advances

The University allows a maximum of $500 on a seven-day period to be issued as a cash advance to any University employee about to travel on University business. Exceptions to the $500 limit must be approved by the President. The amount will be issued by check through Accounts Payable.

Cash advances are intended for anticipated expenses that are best paid in cash (e.g., taxi fare, gratuities, etc.).

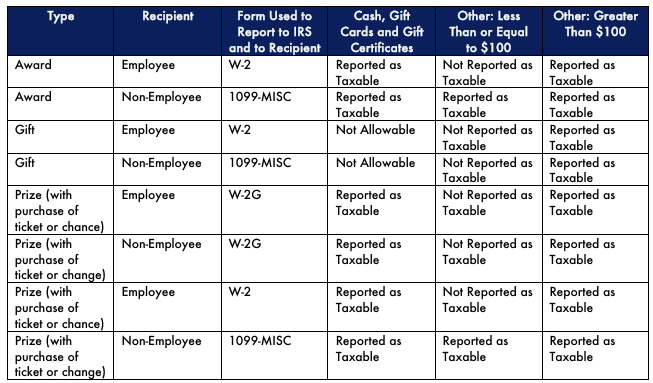

Cash advances may not be used for airfare, lodging, conference fees, or other substantial costs that can be paid using the credit card or can be “prepaid” and invoiced through Accounts Payable. Because of tax implications, cash advances may not be used for service payments such as honorariums, or for gifts, prizes, or awards.

Cash advances must be cleared within 60 days from the “end date” of the trip or event specified on the cash advance request.

Abuse of cash advance privileges may result in revocation of such privileges.

Canceled Trips/Events

Employees who have purchased tickets for trips that are subsequently canceled should inquire about using the same ticket for future travel. Unused tickets or flight coupons have a cash value up to 12 months from the date of original purchase and must not be discarded or destroyed. The ticket must be kept by the school, department, or unit for future use of the employee, as tickets are non-transferable, and name changes are not allowed.

The University will only reimburse those expenses related to a canceled trip or event if the cancellation was due to circumstances beyond an employee’s control. A memo explaining the cancellation should be provided with the reimbursement request.

Other expenses related to events or trips that are canceled or moved to later dates due to unavoidable or work-related reasons will be reimbursed. Such expenses include charges made by airlines for ticket modifications or by hotels for canceled or no-show reservations.

DEFINITIONS

Non-Permissible Expenses: Expenses that are not related to any activity of the University, are not required in carrying out an individual’s task or responsibility at work, or do not benefit the University.

Per diem: Being reimbursed at an amount set as meal and incidental expense allowance for each day of travel.

EXCEPTIONS

None

Travel Expense Request Forms5.89 GUEST TRAVEL

| Purpose: | To ensure compliance with IRS travel and State regulations and provide university policy and guidance on guest travel authorization and expenses incurred |

| Scope: | All guests who travel on University business |

| Responsible Departments: | Finance Office |

| Effective Date: | July 1, 2019 |

| Modification History: | March 5, 2025 |

| Related Policies: | – |

| Related Form(s): | Guest Travel Expense Form |

POLICY STATEMENT

The University’s policy is to pay for necessary and reasonable travel expenses incurred for authorized University business by approved non-employee guests. The intent of this policy is for payments be fair and equitable to both the traveler and the University and consistent with federal regulations. Individuals traveling on business are responsible for complying with University travel policy, and should exercise the same care in incurring expenses as they would in personal travel.

Non-University individuals may be reimbursed for travel expenses incurred in connection with their travel to the University including:

• guest lecturers or researchers

• consultants

• research subject participants

• prospective faculty or staff

• current or prospective business/project partners

Prospective employees may be reimbursed for travel expenses incurred in connection with an employment interview at the University, if authorized by the hiring department.

Authorization must be given prior to travel by the President for guest who is traveling to conduct University business.

The following principles shall be considered when approving:

• The guest’s presence serves a bona fide University business purpose

• The purpose for the guest’s travel must directly support the University’s mission of teaching, research, outreach and economic development (including fundraising)

• The expenses must be reasonable, allowable, and allocable under governing laws, regulations, and University policy. If a guest has no significant role in the proceedings or performs only incidental duties of a social or clerical nature, attendance does not constitute a bona fide business purpose.

Under IRS regulations, the travel expenses of a guest are not taxable, provided it can be established that his or her presence serves a bona fide business purpose. A guest who attends a function is considered to have a business purpose if his or her presence is required to achieve the purpose of the travel, or if he or she has a significant role in the proceedings, which makes an important contribution to the success of an event. Protocol and tradition may dictate when the participation of a high-level official’s guest is required at official University functions, such as alumni gatherings, fund-raising or ceremonial activities, certain athletic events, and community events.

Documentation must be provided with the travel expense reimbursement to show that the guest’s attendance at the function meets the above conditions (e.g., an event or meeting agenda listing the name of the guest, or an invitation addressed directly by name to the guest requesting participation in the meeting or event).

PROCEDURES

Event organizers are expected to submit a Guest Travel Expenses Form at the conclusion of a guest’s travel to BAU to participate in a hosted event.

Instructions and Limitations

• The reimbursement of visitor travel is contingent upon available and allocable funding.

• Expenses can be made on by the guest on a personal credit card and submitted for reimbursement at the conclusion of travel.

• Travel meal receipts are capped at $100 per day.

• DMV Transportation is capped at $200 for the entire trip. This includes taxi, shuttle, mileage for personal car, and/or parking fees.

• Any receipts deemed excessive by the University will not be reimbursed.

Proof of Payment

• Dated original receipts or invoices for expenses must be provided to the University for reimbursement.

• In accordance with IRS rules, the documentation must support the cost and business character of the transaction, and, for a reimbursement, must show evidence of payment.

• Credit card statements are proof of payment, but are not considered to be itemized receipts, and generally do not constitute sufficient documentation alone. Guests may be asked to seek itemized receipts from merchants if an itemized receipt is missing.

• BAU does not offer per diem for University visitors, and will only reimburse from receipts which meet the University’s reimbursement policies.

BAU will only reimburse the most economical method of travel. This usually consists of economy flights; however, sometimes alternate methods of travel are requested, such as renting a car or driving a personal vehicle. In those instances, BAU will reimburse the equivalent value of the most economical method of travel.

Airfare

• BAU reimburses airfare at the lowest available Standard Economy rate (including carry-on luggage).

• An invoice, itinerary, and/or receipt listing all times of departure, flight numbers, class of service, fare basis, ticket number/confirmation number, costs, and proof of payment (i.e., card being charged) is required at the conclusion of travel.

• Additional legroom for international flights may be reimbursed only if the international flight duration exceeds 8 hours of continuous flight time

• Ancillary airline fees (e.g. convenient or early boarding, seat location, baggage, in-flight meals) should be incurred responsibly and should not be excessive.

• In-flight wi-fi and other entertainment expenses will not be reimbursed.

Transportation Passes, Taxi, and Rideshare

• Passenger copies of public transportation tickets, taxi fare, or ride share receipts may be submitted for reimbursement.

• Documentation must contain date of transaction, fare, and payment information.

• DMV regional travel is capped at $200 for the entire trip.

Car Rentals

If use of the rental vehicle is the most economical mode of transportation, the University will pay the traveler for the cost of renting a compact or standard size car and for the automobile-related expenses.

The traveler must provide the University with the original car rental agreements or invoices showing proof of payment for reimbursement. Whenever possible, please include “Bay Atlantic University” in addition to the guest’s name on rental car agreements for travel relating to BAU business.

Travelers will not be reimbursed for insurance from a car rental agency.

Mileage for Private Automobile

If driving is the most economical method of travel, the University will pay a standard rate per mile (defined by the IRS) for official travel by private automobile based on the actual driving distance by the most direct route. The standard mileage allowance (rate per mile multiplied by miles traveled) is intended to cover vehicle expenses such as fuel and lubrication, towing charges, physical damage to the vehicle, repairs, replacements, tires, depreciation, insurance, etc. The use of personally owned vehicles is generally most appropriate for round trips of 200 miles or less. Commercial air travel is generally the most economical and practical means for more distant trips.

To claim mileage, guests must provide a copy of a map of the most direct route between the origin address and destination address for each portion of the trip a mileage reimbursement is requested.

Other Vehicle Expenses

In addition to the standard mileage allowance, necessary and reasonable charges for the following vehicle-related expenses are allowed: Tolls, Ferries, Parking, Bridges, Tunnels. Traffic ticket and parking ticket expenses will NOT be reimbursed.

Travel Advances

The University does not provide travel advances for guests.

Lodging

• University guests are expected to use lodging accommodations that are necessary and reasonable. As such, BAU will only reimburse the lowest standard room rate available.

• Lodging may not exceed $600 per night for the lowest standard room rate available.

• An itemized lodging bill indicating the cost of the room and payment information is required.

Travel Meals

A Travel Meal is defined as an individual meal incurred while traveling for University business.

• No additional justification is needed for travel meals as long as it occurs within the travel period.

• Guests must provide copies of actual receipts to be eligible for reimbursement.

• Both the itemized meal receipt and the credit authorization/payment confirmation receipt must be provided.

• Travel Meal reimbursement is capped and may not exceed $100 per day

DEFINITIONS

–

EXCEPTIONS

None

Guest Travel Expense Form5.90 BOARD TRAVEL

| Purpose: | To ensure compliance with IRS travel and State regulations and provide university policy and guidance on board members’ travel authorization and expenses incurred |

| Scope: | All board members |

| Responsible Departments: | Finance Office |

| Effective Date: | July 1, 2019 |

| Modification History: | March 5, 2025 |

| Related Policies: | – |

| Related Form(s): | Board Travel Expense Form |

POLICY STATEMENT

Members of the Board of Trustees serve without compensation but are entitled to reasonable amounts for expenses necessarily incurred in the performance of their duties. Even though the board meetings are conducted online, members are encouraged to attend one board meeting in person annually. Members shall be eligible for reimbursement of expenses for such meetings that they attend in person.

In other instances, if a board member needs to travel to conduct official University business, such as attending an accreditation meeting, University covers expenses incurred by such travel.

The Board of Trustees acknowledges that the President of the University serves as the Approver of board travel expenses. The President may delegate the responsibilities of the Approver to another University officer to assist with trustee travel and expense accounting and administration.

PROCEDURES

Members may be reimbursed or have appropriate expenses paid in advance for travel expenses related to official University business up to the extent of the reimbursement limits proscribed under this policy. Proof of the use and purpose of those resources shall be provided before reimbursement is made. When making any request for reimbursement for travel and expenses, Members of the Board must submit a Board Travel Expense Form to the President or the designated officer by the President. All travel vouchers, or the equivalent thereof must be accompanied by receipts or other documentation documenting the expenses incurred by the Member. Members are personally responsible for the accuracy and proprietary of any travel vouchers that they are submitting. Any expenses incurred over those allowed for reimbursement are the personal responsibility of the respective Board Member.

Members of the Board are expected to make prompt submission of any requests for reimbursement, but no later than 30 calendar days after the conclusion of the travel or event from which the respective Member makes the reimbursement request.

The University budget shall include projected costs of Board travel and expenses.

Proof of Payment

• Dated original receipts or invoices for expenses must be provided to the University for reimbursement.

• In accordance with IRS rules, the documentation must support the cost and business character of the transaction, and, for a reimbursement, must show evidence of payment.

• Credit card statements are proof of payment, but are not considered to be itemized receipts, and generally do not constitute sufficient documentation alone. Guests may be asked to seek itemized receipts from merchants if an itemized receipt is missing.

• BAU does not offer per diem for Board Members and will only reimburse from receipts which meet the University’s reimbursement policies.

BAU will only reimburse the most economical method of travel. This usually consists of economy flights; however, sometimes alternate methods of travel are requested, such as renting a car or driving a personal vehicle. In those instances, BAU will reimburse the equivalent value of the most economical method of travel.

Airfare

• BAU reimburses airfare at the lowest available Standard Economy rate (including carry-on luggage).

• An invoice, itinerary, and/or receipt listing all times of departure, flight numbers, class of service, fare basis, ticket number/confirmation number, costs, and proof of payment (i.e., card being charged) is required at the conclusion of travel.

• Additional legroom for international flights may be reimbursed only if the international flight duration exceeds 8 hours of continuous flight time

• Ancillary airline fees (e.g. convenient or early boarding, seat location, baggage, in-flight meals) should be incurred responsibly and should not be excessive.

• In-flight wi-fi and other entertainment expenses will not be reimbursed.

Transportation Passes, Taxi, and Rideshare

• Passenger copies of public transportation tickets, taxi fare, or ride share receipts may be submitted for reimbursement.

• Documentation must contain date of transaction, fare, and payment information.

• DMV regional travel is capped at $200 for the entire trip.

Car Rentals

If use of the rental vehicle is the most economical mode of transportation, the University will pay the traveler for the cost of renting a compact or standard size car and for the automobile-related expenses.

The traveler must provide the University with the original car rental agreements or invoices showing proof of payment for reimbursement. Whenever possible, please include “Bay Atlantic University” in addition to the Member’s name on rental car agreements for travel relating to BAU business.

Mileage for Private Automobile