ASSET AND LIABILITY MANAGEMENT

This section establishes frameworks for the sound management of assets and liabilities. The purpose of these policies is to define the principles for prudent management of the University’s assets, liabilities and equity, and to identify and manage resultant risks, while ensuring income stability.

The policy numbers in this section range from 5.110 to 5.119. Any new policy added to this section will be assigned a number within this range.

5.110 CAPITAL ASSET

| Purpose: | To identify the threshold of cost for capital assets and procedures for recording them |

| Scope: | All university owned and non-university owned capital assets |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | July 1, 2024 |

| Related Policies: | 5.111 Depreciation Policy |

| Related Form(s): | – |

POLICY STATEMENTS

The costs of all assets used in operations that are acquired or constructed should be capitalized as a Capital Asset when the cost or the fair value, at the date of acquisition or donation, meet the thresholds established within this policy and the expected Useful Life is greater than one (1) year. Generally, holding title to an asset equates to ownership, and the entity that has ownership of an asset should report the asset in its financial statements.

BAU records equipment with a useful life of more than 1 year and cost of more than $10,000 as an Asset. Equipment with useful life under 1 year and/or cost of $10,000 or less is recorded as a supply

expense.

PROCEDURES

The acquisition value of an asset includes all costs of the asset and all additional costs necessary to place the asset in its intended location and condition for use. This may include freight and installation costs and excludes training costs. An acquisition may be made by a purchase, gift, construction or lease purchase. Below outlines the valuation for the asset under each method:

- Purchase: recorded at actual cost paid, including freight and installation costs, and net of any discounts. For additional costs that may be considered, see the Asset Specific Capitalization Components sections below. Trade-In Allowances: to determine the value of a Capital Asset, use the value before trade in allowances are applied (i.e. the value will typically be greater than the amount paid).

- Gift: recorded at fair market value as of the date of the acquisition plus any costs incurred with the acceptance of the gift.

- Construction: recorded at cost and includes all identifiable direct costs such as drawings, blueprints, component parts, contract costs, insurance, materials, and supplies consumed in fabrication, labor, and installation. Non-consumable supplies, such as tools that may be used again with different assets, should not be included. During construction, expenses should be charged to capital accounts.

- Lease: recorded at the total cost of the lease net of interest expense (the present value at the inception of the lease).

In limited circumstances, assets may be recorded as composite assets in which more than one asset is grouped together for the recording of the capital asset. Capitalization thresholds still apply to the individual asset in determining whether the item should be capitalized or expensed. The composite asset method of recorded assets should only be used when there is a large volume of similar assets that would be depreciated under the same useful life.

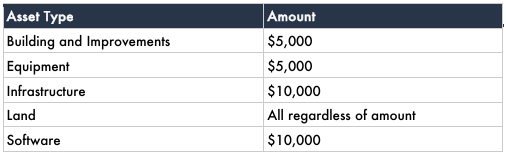

Thresholds for the capitalization of an asset are as outlined below. Items that fall below the established thresholds should be expensed in the period the cost is incurred.

Asset Specific Capitalization Components

Land and Buildings

The asset value of Land or Buildings may include costs necessary for the purchase such as appraisal, title, recording, and legal fees. When Land is acquired with Buildings erected thereon, the total cost is allocated between the categories of Building and Land at the date of acquisition, regardless of the intent for use (excluding assets held for resale). This allocation should be based on the executed purchase documents. If the purchase documents do not show the allocation, other sources of the information may be used such as expert appraisals or the real estate tax assessment records.

Software Development and Purchases

Consistent with the GAAP, new software projects with Direct Costs greater than or equal the established threshold should be capitalized. The software implementation project must be broken down into three stages:

- Project Stage – costs associated with the selection of the specific software.

- Development Stage – begins once the preliminary project stage has been completed and management with the relevant authority (explicitly or implicitly), authorizes, and commits to funding a computer software project and believes it is probable the project will be completed and the software will be used to perform the intended function.

- Post-Implementation/Operation Stage.

In addition to the cost of the software, only expenses incurred during the application development stage should be capitalized. At the point of the development stage, the costs incurred to develop or obtain computer software for internal use should be capitalized and accounted for as a Capital Asset. Capitalization ceases at the point at which the software is substantially complete including all necessary testing and is ready for use. General and administrative costs, as well as overhead, are not capitalized for internal use software.

Both internal and external costs incurred to install, configure, code, and test software are capitalized. The cost of testing, as well as installing, the software should be capitalized. The costs included in the value of the Capital Asset, once the capitalization period has begun, would be the following:

- External Direct Costs (i.e., from third-party transactions) of materials and services consumed in developing or obtaining internal use software,

- Payroll and benefits costs for employees who devote a substantial amount of time during the application stage. Substantial time on a project is the lesser of 500 hours or an amount set by the President.

- The costs of developing bridging software should be capitalized, but only if the software is used for this specific data conversion effort and there is no alternative future use for the bridging software.

- Developed or obtained software that allows for access of old data by new systems.

- Training for the design or functionality of the software should be capitalized if determined to be material to the project. The costs of training users on the use of the software should be expensed.

- Software upgrades should generally not be capitalized and should be considered maintenance, and accordingly expensed as incurred. Only upgrades or enhancements that can be demonstrated to have substantial additional functionality beyond the original software would be capitalized.

University Constructed Assets

Costs incurred during construction or fabrication for assets budgeted to meet the capitalization threshold must be charged to a capital account. Identifiable direct costs during construction or fabrication could include: drawings, blueprints, component parts, materials, supplies consumed in construction/fabrication, labor, and installation. In progress/process accounts should be used for constructed assets that are still in progress or not yet in service (less than 95% complete).

Costs for studies, including but not limited to engineering and feasibility studies, should not be capitalized as part a capital asset unless it is probable that the project will proceed through completion of the asset.

Capital Leases

Leased Assets are capitalized if it meets the criteria if at inception it meets any one of the following criteria:

- It transfers ownership of the property to the lessee by the end of the lease term;

- It contains a bargain purchase option;

- The lease term is 75% or more of the estimated economic life of the lease property; or

- At the beginning of the lease term, the present value of the minimum lease payments (excluding executory costs) equals or exceeds 90% of the excess of the fair of the leased property.

Repairs, Improvements, and Enhancements

The costs of additions, major repairs, enhancements, or improvements subsequent to the initial acquisition should be capitalized if the following are met:

- The costs meet the capitalization threshold; and

- Useful Life of the asset is extended beyond its original life; or

- Functionality of the asset is extended and/or the service capacity or efficiency is increased.

Repair or maintenance expenditures that keep the asset in its normal operating condition or that bring the asset back to its original state without either extending the Useful Life or improving upon the functionality or service capacity of the asset are not considered capital expenditures and should be expensed in the period incurred. Examples of non-capital repair or maintenance include but are not limited to the following:

- Maintenance Agreements/Contracts

- Preventative Maintenance

- Janitorial Services

- Window Washing

- Extermination Services

Ownership of the Asset and Asset Inventory

All Capital Assets must be inventoried. In addition to assets that the University is the owner, assets that are provided by an external sponsor must also be inventoried, regardless of whether the title is retained by the sponsor or the University. Federal, state, and private grant funded capital Equipment is classified depending on ownership or title to the Equipment. Title to or ownership of Equipment is determined by the provisions of the sponsoring award, contract, or agency policy and fall under three classifications of grant funded capital Equipment:

- Sponsored Purchased/University-owned – reported and capitalized as a University asset.

- Sponsored Purchase/Government-owned – recorded in Asset Management as Non-University Owned with a unique tag. However these assets are not reported in the Universities financial statements. Government-titled Equipment may not be disposed or removed from service without approval from the sponsoring agency.

- Government Furnished Property – recorded in Asset Management as Non-University Owned with a unique tag. However these assets are not reported in the Universities financial statements. Government- furnished property must be appropriately identified and tracked by the receiving department. The department should also notify their campus Sponsored Programs Office when the Equipment is received for special reporting requirements.

All inventoried assets must be tracked and disposed of in accordance with the terms and conditions of the external sponsor’s requirements. This is applicable to sponsored project assets as defined by the sponsor.

Federally funded Equipment should be managed in accordance with the OMB Uniform Guidance and Federal Acquisition Regulations (FAR), specifically FAR Parts 45 and 52.245. In addition, certain sponsors may have capital Equipment requirements in the terms and conditions of the award.

DEFINITIONS

Capital Assets – an asset used in operations that has an expected Useful Life of greater than 1 year. These assets may include Land, Land improvements, Infrastructure, buildings, building improvements, vehicles, Equipment, works of Art and Historical Treasures, and all other tangible or intangible assets that meet this definition. A Capital Asset should be self-contained for its primary function (not a component part of any other assets); Expenditures that meet or exceed thresholds are recorded as capital assets and depreciated over their Useful Life rather than being treated as an expense in the accounting period the cost is incurred.

Useful Life – the time period over which an asset is expected to provide service potential.

Equipment – physical assets that are not permanently affixed to buildings.

Infrastructure – includes streets, pavements, landscaping, utility and telephone distribution systems, and parking lots. All identifiable costs are included such as (but not limited to) contract costs and insurance costs during the period of construction.

Land or Real Property – the term real property refers to land. Land, in its general usage, includes not only the face of the earth but everything of a permanent nature over or under it. This includes structures and minerals. Land acquired by gift or bequest is recorded at the fair market value at the date of acquisition.

Direct Costs (software) – include the cost of the software or fair market value of the software if acquired by gift, and any projected direct costs such as consulting expense needed to install, configure, code and test the software.

Non-University Owned – an asset that is titled to an entity other than the University but is in the University’s possession. The thresholds applicable to University owned Equipment apply here unless the owner requires a different threshold in which case the Asset Management system will be used to track the Equipment.

Sponsored Purchased/University-owned – Equipment purchased in whole or in part with federal or other sponsoring agency funds with title vested to the University.

Sponsored Purchased/ Government-owned Equipment – Equipment purchased with federal funds with title vested to the federal government is considered “government-owned Equipment.”

Government-furnished Property – Equipment in the possession of, or acquired directly by, the federal government and subsequently delivered or otherwise made available to the University under a grant or contract is considered “government-furnished property.” Title to government-furnished property remains with the government, regardless of the Equipment’s value.

EXCEPTIONS

None

5.111 DEPRECIATION

| Purpose: | To ensure compliance with external reporting requirements on depreciation of capitalized assets |

| Scope: | All capitalized assets owned or accounted for by BAU |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | – |

| Related Policies: | 5.110 Capital Asset Policy |

| Related Form(s): | – |

POLICY STATEMENT

This policy provides guidance as to the application of GAAP for the University to ensure compliance with external reporting requirements.

PROCEDURES

Capital Assets are depreciated using a straight-line method over the expected Useful Life of the asset with depreciation expense being recognized in plant funds. The Depreciation for each asset will begin on the in-service date for the Capital Asset.

For the purpose of Depreciation, the University has identified the following categories of Capital Assets that are depreciated.

- Buildings and Building Components (including Building Improvements)

- Infrastructure

- Equipment and Furnishings

The following categories of Capital Assets are not depreciated:

- Land

- Construction in Progress

- Equipment in Progress

DEFINITIONS

Depreciation: is an element of expense resulting from the use of long-lived Capital Assets. It is conventionally measured by allocating the expected net cost of using the asset (original cost less estimated salvage value) over its estimated Useful Life in a systematic and rational manner.

Useful Life: the time period over which an asset is expected to provide service potential.

EXCEPTIONS

- Land

- Construction in Progress

- Equipment in Progress

5.112 DONATED MATERIALS, EQUIPMENT, AND SERVICES

| Purpose: | To identify methods of recording donated materials, equipment, and services |

| Scope: | All materials, equipment, and services donated to the University |

| Responsible Departments: | Finance Office |

| Effective Date: | May 2, 2014 |

| Modification History: | – |

| Related Policies: | 5.110 Capital Asset Policy |

| Related Form(s): | – |

POLICY STATEMENT

BAU records in-kind gifts of equipment as in-kind contributions, a revenue account, and as equipment, an asset account.

PROCEDURES

BAU records in-kind gifts of equipment as in-kind contributions, a revenue account, and as equipment, an asset account. Donated equipment is recorded at the fair market value on the date of donation. Fair market value is the price at which the item would be sold by a willing buyer to a willing seller.

Donated material which does not meet the definition of equipment is not recorded as “in-kind supplies expense” and “in-kind contribution”. Volunteer time of professionals in their professional capacity is recorded as “in-kind revenue” and “in-kind expense.” Other volunteer time is not recorded. There is no net effect of recording in- kind labor and its associated in-kind contribution income. The recording of in- kind contribution income for the value of donated equipment results in an increase in net income because the value of the donated equipment is recorded as an asset not as an expense

DEFINITIONS

–

EXCEPTIONS

None

5.113 LEASES AND SOFTWARE SUBSCRIPTIONS

| Purpose: | To provide guidance as to the application of GAAP for the University to ensure compliance with external reporting requirements for leases and software subscriptions. |

| Scope: | All leases and software subscriptions for which the University has the right to use an asset used in operations (University is the lessee). In addition, it applies to all leases for which the University is the owner of an asset and leases the asset to parties outside of the University (University is the lessor). |

| Responsible Departments: | All de |

| Effective Date: | May 2, 2014 |

| Modification History: | – |

| Related Policies: | 5.80 Payroll Policy |

| Related Form(s): | – |

POLICY STATEMENT

The Governmental Accounting Standards Board (GASB) issued Statement No. 87, Leases, and GASB 96, Subscription-Based Information Technology Arrangements, which establishes a single reporting model for lease and IT subscription accounting. GASB 87 changes the definition of a lease to eliminate the “capital” and “operating” differences.

All leases meeting the GAAP criteria require lessees to recognize a lease liability and intangible Right-of-Use asset and lessors to recognize a lease receivable and a deferred inflow of resources.

Examples of nonfinancial assets include buildings, land, vehicles, and equipment.

All contracts that contain a lease of an asset or IT subscriptions should be reviewed and reported as a Right-to-Use (ROU) asset if it meets the criteria outlined in this policy. The University should consider the following when determining whether a contract that is reportable as a Right-of-Use asset:

- A contract is in place that contains the right to use the underlying asset as specified in the contract

- Contains a specified period of time

- The transaction is exchange or exchange-like, meaning both parties in the contract receive or give up equal value or something more than a nominal amount is exchanged.

PROCEDURES

The following thresholds should be considered when recording a lease of software subscription for GAAP reporting as an asset and associated liability.

- Land, buildings and equipment (excluding copiers and vehicles) are recorded regardless of the dollar value of the contract.

- Copiers and vehicles contracts of a total value (including optional renewals) of $50,000 or more are considered reportable as a lease.

- IT software subscriptions contracts of a total value (including optional renewals) of $500,000 or more are considered reportable as a software subscription.

Right-of-Use in a contract does not have to include 100% access to the asset to qualify as a GASB reportable lease. A Right-of-Use lease also includes use for portions of time, such as certain days of the week or hours as outlined in the contract.

A contract may contain multiple components. Some of which may meet the definition of the lease along with some that may not. All contracts should be examined to determine if a lease is embedded into a contract and requires reporting, prior to the first payment due.

Leases must be recorded at the total cost of the lease net of interest expense (the present value at the inception of the lease). In the absence of a stated interest rate in the contract, the University will use its borrowing rate, as calculated by the Finance Office. The borrowing rate will be updated on a fiscal year basis and applied to all new leases entered into during the fiscal year. If there is a significant change in the rate, it may be updated and applied to leases on a more frequent basis. Significant is defined as a change in greater than 1% and will be evaluated by the CFO with a new bond issuance.

Software subscription implementation costs are broken down into three stages. Each stage is outlined below with how those costs are recorded.

- Preliminary Project Stage – includes costs from the conceptual formulation and evaluation of alternatives, the determination of need and the final selection of alternatives for the software subscription. Costs in this stage are expensed as incurred.

- Initial Implementation Stage – includes ancillary charges related to the design of the chosen subscription, such as configuration, coding, testing and installation. This stage is completed when the software subscription asset is placed into service and is to be included in the asset value recorded for the software subscription ROU Asset.

- Operation and Additional Implementation Stage – includes maintenance, troubleshooting, and other ongoing costs to access the software. These costs are expensed as incurred unless the cost is associated with modifications to the subscription software, which would be included in the capitalization of the ROU Asset.

An annual inventory is required for ROU assets and shall follow the same process as University owned capital asset inventory controls.

Lessor Accounting (Receivables Leases)

A lease receivable and a deferred inflow of resources will be recorded when the University is the lessor. The receivable is equal to the present value of lease payments expected to be received during the lease term, reduced by any provision for estimated uncollectible amounts. Non-operating lease revenue and interest revenue will be recorded on a straight-line basis over the term of the lease. As the lessor, the University will continue to recognize the asset underlying the lease in accordance with the Capital Assets and Depreciation policies.

The CFO must monitor financials closely to ensure proper payments/receipts recording for leases including but not limited to: proper accounts, amounts, and alignment with lease terms, monitor automated fixed lease payments and pay any non-fixed payments due, must complete annual inventory of ROU Assets and validate that the University still has possession of the asset and where the University is the lessor, monitor lease invoices and ensure payments are matched to appropriate invoice created and non-fixed lease components are collected from the Customer.

DEFINITIONS

Lease – a contract that conveys the control of the right to use another entity’s nonfinancial asset as specified in the contract for a period of time in an exchange or exchange-like transaction.

Right-to-Use (ROU) Asset – lessee has the ability to use an asset owned by another party over the life of a lease and title remains with the outside party.

Software Subscription – a contract where the University has the ability to use another party’s software asset, either alone or in combination with tangible capital assets over the life of the contract and title remains with the outside party.

Short-Term Lease – a lease that, at the commencement of the lease term, has a maximum possible term under the contract of 12 months (or less), including any options to extend, regardless of the probability of being exercised.

Fixed lease payment – contractually required payments outlined in the lease contract that are fixed in nature, including payments that have escalations, such as Consumer Price Index (CPI) or stepped increases. Payments that are based on future performance are not fixed payments.

EXCEPTIONS

Certain contracts are excluded from the Right-of-Use criteria of reporting. Those exclusions are as listed below:

- Contract criteria should not be applied to biological assets, inventory, supplies, service concession arrangements, assets held as investments or internal leases.

- Short-Term contracts that have a total non-cancellable term equal to 12 months or less, including renewals, should not be reported as a lease or subscription.

- Contracts containing leases that transfer ownership at the end of the term should be treated as a financed purchase rather than a Right-of-Use transaction.

- Contracts that are cancellable by either party at any time for any reason, including the notice period.

- Payments that are variable in nature should be excluded from the asset and liability calculation. If a minimum payment is required in the variable calculation, the minimum must be recorded as part of the asset and liability.

5.114 EMPLOYEE RETIREMENT ACCOUNTS

| Purpose: | The University 401(k) Retirement Plan Policy outlines the provisions and procedures for employee participation, contributions, and benefits under the University’s tax-advantaged retirement savings plan. The policy supports the University’s commitment to providing competitive retirement benefits for its employees. |

| Scope: | Applies to all staff |

| Responsible Departments: | Human Resources |

| Effective Date: | September 1, 2024 |

| Modification History: | – |

| Related Policies: | BAU Summary Plan Description (attached) |

| Related Form(s): | 401(k) Enrollment Form Beneficiary Designation Form Hardship Withdrawal Request Form (Employees must request these forms through the Plan Administrator) |

POLICY STATEMENT

The University 401(k) Plan (“Plan”) is a qualified retirement plan established to help employees save for retirement through pre-tax and post-tax (Roth) contributions, and employer matching. The Plan complies with applicable federal laws, including the Employee Retirement Income Security Act (ERISA), and adheres to the principles of equal opportunity and non-discrimination.

PROCEDURES

Eligibility

Employees are eligible to participate in the Plan upon meeting the following requirements:

- Minimum Age: 21 years.

- Service Requirement: Completion of 90 days of employment.

- Entry Date: Participation/open enrollment begins on the first day of the Plan Year or the first day of the seventh month of the Plan Year following eligibility.

Excluded Employees: Highly compensated employees, as defined by IRS regulations, and certain categories of temporary or seasonal employees are excluded from Plan participation.

Employee Contributions

- Salary Deferrals: Employees may elect to contribute a percentage of their compensation on a pre-tax or Roth basis, subject to IRS annual contribution limits.

- Catch-Up Contributions: Employees aged 50 or older may make additional contributions above the annual limit, in accordance with IRS guidelines.

- Rollover Contributions: Employees may roll over eligible funds from other qualified retirement plans or IRAs, subject to Plan Administrator approval.

Employer Contributions

- The University will match employee contributions up to 6% of the employee’s compensation, as determined annually.

- Matching contributions are allocated regardless of service duration within the Plan Year.

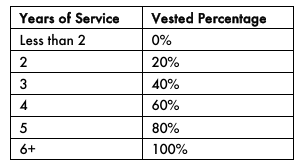

Vesting Schedule

Employees are always 100% vested in their salary deferrals and rollover contributions. The vesting schedule for employer contributions is as follows:

Plan Investments

- Participant-Directed Investments: Employees may direct the investment of their account balances. Information on available options and default investments is provided during enrollment.

- Investment Responsibility: Employees bear the risks and rewards of their investment choices. The University does not guarantee investment performance.

Distributions and Withdrawals

- Termination of Employment: Participants may access vested account balances upon retirement, disability, or other termination of employment.

- Hardship Withdrawals: Permitted for qualifying financial needs as defined by IRS rules, including medical expenses, tuition, and mortgage payments.

- Required Minimum Distributions (RMDs): Commence no later than April 1 following the year the participant reaches the required age (as per IRS regulations).

Plan Administration

The Plan is administered by the Human Resources Department, which oversees eligibility determinations, contribution allocations, and compliance with ERISA and IRS regulations. Employees may contact the Plan Administrator for account information or questions.

Modification and Termination

The University reserves the right to amend or terminate the Plan at any time, in compliance with applicable laws. Notice will be provided to participants of any changes affecting their rights or benefits.

DEFINITIONS

Part-time employees: Those working 20 hours per week.

Full-time employees: Those working 40 or more hours per week.

401(K) Summary Plan Description: BAU 401(k) Plan (“Plan”) has been adopted to provide BAU staff with the opportunity to save for retirement on a tax-advantaged basis. This Plan is a type of qualified retirement plan commonly referred to as a 401(k) Plan. BAU staff can request the Plan from the HR Office.

EXCEPTIONS

Excluded Employees: Highly compensated employees, as defined by IRS regulations, and certain categories of temporary or seasonal employees are excluded from Plan participation.

5.115 OPERATING RESERVE

| Purpose: | To identify the target minimum operating reserve and how it is used |

| Scope: | All university |

| Responsible Departments: | Finance Office |

| Effective Date: | July 1, 2021 |

| Modification History: | – |

| Related Policies: | – |

| Related Form(s): | – |

POLICY STATEMENT

The target minimum operating reserve fund for the organization is three (3) months of average operating costs. The calculation of average monthly operating costs includes all recurring, predictable expenses such as salaries and benefits, occupancy, office, travel, program, and ongoing professional services.

PROCEDURES

The amount of the operating reserve will be calculated each year after approval of the annual budget, reported to the Finance Committee and Board of Directors, and included in regular financial reports. The operating reserve will be funded with surplus operating funds.

The operating reserve available in cash is maintained in the general cash account of the University. The President authorizes the use of this reserve. The University’s goal is to replenish the funds used withing twelve (12) months to restore the operating reserve fund to the target minimum amount.

The President monitors the status of the operating reserve and reports to the Board of Directors.

DEFINITIONS

–

EXCEPTIONS

None

Online Application Form

TAKE THE FIRST STEP TOWARDS CRAFTING YOUR STORY!

Contact Our Admissions

Officers Today!

- Personalized Guidance

Our admission officers guide you to the right programs. - Timely Responses

Swift and informative communication for a stress-free admission journey. - Exclusive Insights

Access exclusive updates, events, and opportunities at BAU.