The rise in college costs presents a big challenge for parents and students. Parents have put more savings into college funds, and students have to juggle part-time jobs to keep up with daily expenses and increasing costs. This increase made students turn to student loans, which has become a $1.7 trillion crisis, as student fees have risen faster than incomes. In this article, we’ll explore what has caused the prices to soar and how you can stay ahead of expenses and debt.

College Costs Today vs. 40 Years Ago

Below, we’ll mention the factors that have weighed on the soaring increase in college prices; but firstly, we must compare today’s prices with those of 40 years ago. College costs today are 180% higher than 40 years ago (1980), with total annual college costs in 1980 being $10,231, whereas in 2019-20 total price was $28,775.

While in the 80s, students could pay their yearly tuition fees by working during the summer or working a part-time job, nowadays, students have to rely on savings, college funds, scholarships, or student loans to pay their yearly tuition. The state funding cuts started a domino effect, pushing universities to increase tuition fees to make up for lost revenue, which in turn put other factors into motion, to end up in a total cost that is barely manageable for a large portion of the population.

Why Have College Costs Risen So Much?

Total college costs (tuition and fees, rent, food, books and other supplies, transportation, and other expenses) can go from $27,330 for public colleges to $55,800 for private colleges. Although many factors have affected college costs over the years, a recent factor is the inflation caused by the pandemic.

The pandemic itself slowed the increase of college costs by only 1.1% for public colleges and 2.1% for private colleges, which is the lowest increase in 30 years. However, this applies to tuition fees as other costs have increased by the recent inflation of oil, food, rent, etc. Below we’ll discuss shortly the five most significant factors that have affected the increase in total college costs.

Higher number of enrollments

Due to the pandemic, in the fall of 2020, 19.4 million students attended colleges and universities, which is 8% lower than in the fall of 2010, when enrollment reached its peak with 21 million students. However, because the rising cost of college isn’t a new phenomenon, the impact of enrollment on tuition costs began in the 80s, when enrollment rates began to increase.

Many experts in the field conclude that the most significant factor that affects college costs is the high demand for college enrollment. To keep up with the higher number of students, universities had to expand the campus and hire more professors, which only increased expenses.

One of the main reasons the enrollment rate has increased is the pressure to go to college. This pressure has increased the competition between students and universities to accept applicants. Universities improved their services and faculties to attract more applicants, which increased their expenses, and in turn, increased total costs. And due to the high competition between applicants, students were “forced” to comply with the price increase.

More student support services in colleges

Universities have invested a lot of resources in providing support services like tutoring, healthcare, mental health services, childcare, financial aid services, etc. Although these services help students achieve their goals, their addition has affected the total college cost, which is students’ most significant source of anxiety and stress. So, this situation has turned into a boomerang effect.

Improved facilities and technology

Because of high standards set by competitors and the high demand by students, universities have invested a lot of resources in improving faculties and technology. They’ve made dining halls more spacious, improved dorm rooms, equipped laboratories with higher quality products, introduced technological advancements in classes, and ran a proficient system.

However, the updated campus and faculties increased maintenance expenses, which added to the overall cost of college.

✅ Request information on BAU's programs TODAY!

Higher utility costs

Because utility prices (water, electricity, sewage) have increased everywhere, colleges must put aside considerable sums of money to pay the bills. These utility costs have to be covered by the total college cost. However, almost all students have to pay utility bills for their personal needs, which only increases their burden for covering all expenses.

Fluctuation in state and local funding

State or local funding helps public colleges and universities with covering a portion of the revenue. However, lately, we are seeing little or no funding growth per student. The state funding per student decreased from $8,800 in 2007 to $8,200 in 2018. Another factor is that the state can’t cover the same ratio per student as before due to the high enrollment rates.

What Can You Do to Stay on Top?

Though the added challenges can make it difficult to stay ahead of payments or even attend college, you can take some measures to ease them, such as:

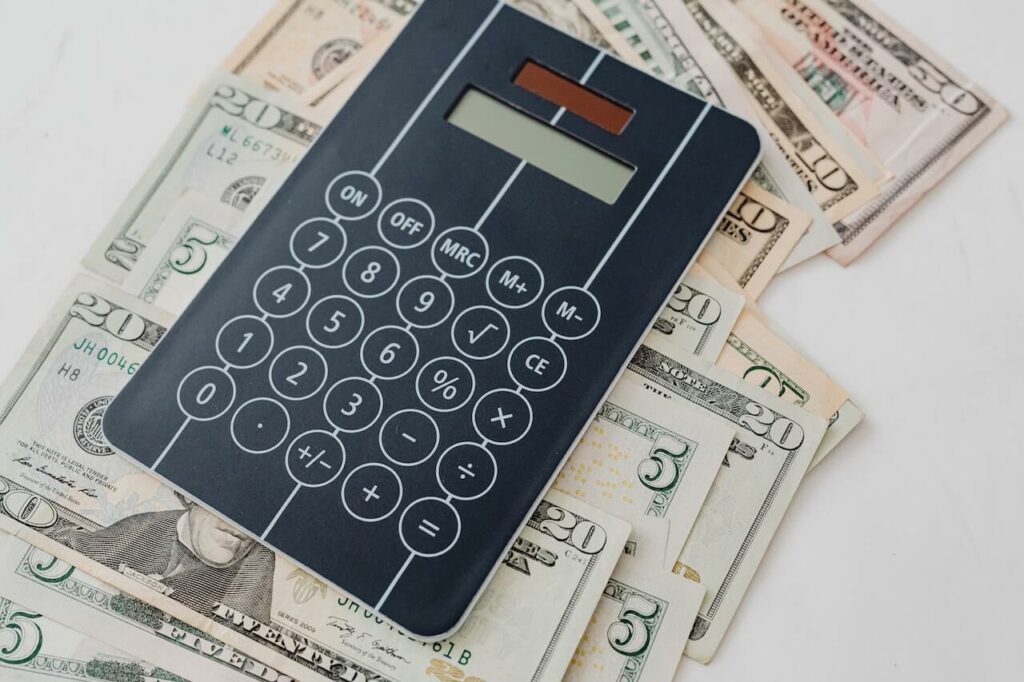

- Budgeting: you should calculate all living and college expenses to see where you can cut expenses.

- Saving: saving as much as possible helps you make payments like rent, buy groceries, pay tuition, etc.

- Applying for financial aid: you can always try filling out the FAFSA and see if you qualify for financial assistance.

- Applying for scholarships: you can apply for scholarships or grants from organizations and local or federal governments.

The Bottom Line

When reading this article, you may doubt your decision to go to college, and you have every right to do so. College shouldn’t be an obligation but a means to advance your knowledge and skills. However, a college degree opens many doors for you and will always be worth pursuing. And even though college costs have grown, the value of an undergraduate degree has not wavered. Sure, college costs have increased exponentially, but keep in mind that with the proper budgeting and planning, you can finish college with minimal debt.