With college costs skyrocketing, students and their families must find additional resources to pay expenses; these resources may be scholarships, grants, financial aid, or student loans. The first step to getting additional help is filling out the FAFSA, a.k.a. the Free Application for Federal Student Aid.

While an independent student can fill out the FAFSA herself or himself, being a dependent student requires additional information. Note: You’re a dependent student if you’re younger than 24 years old, are single, don’t have children, etc.

We advise that as a parent or a guardian, you ensure your child’s access to as much student aid as possible, even if you won’t pay for their tuition. Your financial information helps colleges and universities assess if your child qualifies for financial assistance and, if so, the amount.

This article will elaborate on what the FAFSA is, how to apply, and what is needed to complete the application.

What Is the FAFSA?

FAFSA is a necessary form for qualifying for financial aid, like grants, federal student loans, and work-study funds. It’s an easy and free way of assessing the estimated financial assistance amount your child will receive according to your income and assets.

After you fill out the FAFSA and the application is processed, you’ll receive a Student Aid Report (SAR) and, on it, the Expected Family Contribution (EFC). The EFC is an index number that helps determine your child’s eligibility for federal student financial aid. You should take note that the EFC amount can be higher than initially stated.

Besides the EFC, the SAR contains a four-digit Data Release Number (DNR) which is needed if you allow your college to change certain information on your FAFSA. Lastly, your SAR includes a summary of your federal student loans, the information you provided on the form, and the estimated eligibility for federal student loans.

How Can You Apply to the FAFSA?

You can apply to the FAFSA at the Federal Student Aid site. You can also apply through the mobile app available for Android and iOS or even download the PDF version of the application.

You, together with your child, can start filling out the application from October 1st for the next academic year. When doing it for the first time, you should fill out the FAFSA at the beginning of their senior year of high school.

What Do You Need to Fill Out the FAFSA Application?

The sheer number of documents needed to fill out the application may make it seem like an overwhelming task; however, if you prepare all the necessary documents beforehand, you can fill out the application in less than an hour and a half or an hour for the renewal of FAFSA.

FSA ID

The first step to filling out the application is creating an ID, which enables you to quickly fill out or update the information every year. You should create an account at least a few days before you plan to fill out the form, as it can take up to three days to be able to use the FSA ID.

Social security number

Your child will need to provide information about his or her social security number; a dependent student will have to provide their parents’ ones. While if you’re not a U.S. citizen, you’ll need to submit your green card or the alien registration number.

Driver’s license number

If applicable, the student will need to provide information on their driver’s license number.

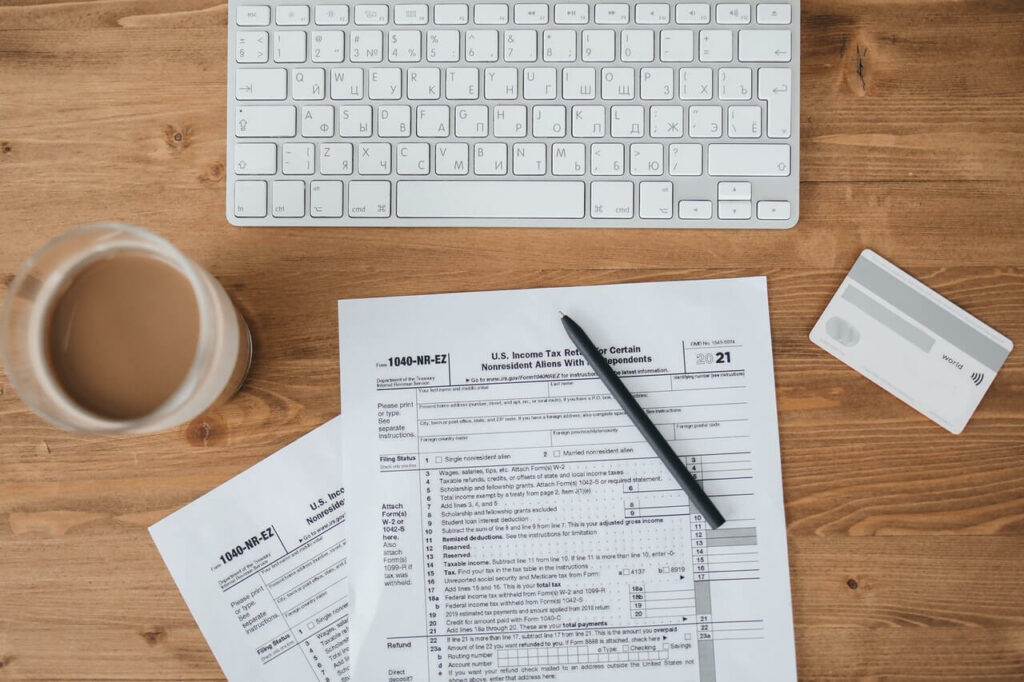

Federal income tax return

For the 2022-23 FAFSA, you’ll need to report the 2020 federal income tax return for you and your child. To transfer your tax information more quickly, you can use the IRS Data Retrieval Tool (DTR) and the 2020 IRS W-2 available for reference. Your child should keep in mind that they have to report the 2020 tax information, even if they’ve experienced a reduction in income. And then contact the college they want to attend to explain and document the change.

Records of untaxed income

In this section, you’ll record untaxed income (child support, interest income, and veterans’ noneducation benefits). Just like for the federal income tax return, for the 2022-23 FAFSA, you’ll need to report information from the 2020 tax return.

Records of your assets

The FAFSA form requires records of savings and checking account balances and the value of investments (stocks, bonds, and real estate). Unlike the reporting for the tax amounts, you need to report the amount as of the date you sign the form. It would be best to carefully record your assets as you wouldn’t want to over- or under-report information.

List of schools your child is interested in

✅ Request information on BAU's programs TODAY!

Up to ten colleges and universities can be selected to receive the FAFSA form. After submitting the application, these universities will receive a copy of the Student Aid Report, EFC, and FAFSA. Your child can always add or remove schools from the application. It’s not a problem if they decide not to apply to some of the colleges they’ve listed, as colleges don’t offer aid until your child has been accepted.

Who Is Eligible to Receive the FAFSA?

Although most U.S. citizens or eligible noncitizens qualify for financial aid for college, you must know the criteria for remaining eligible or how to get your eligibility back. Some of the basic eligibility criteria are:

- Demonstrating financial need,

- Being a U.S. citizen or an eligible noncitizen,

- Having a high school diploma or a GED,

- Being enrolled or accepted for enrollment as a regular student,

- Maintaining satisfactory academic progress, etc.

While there isn’t an income cut-off, many circumstances can determine the amount you’ll get. Some of them are:

- A student with a parent who was killed in Iraq or Afghanistan after the events of 9/11 might be eligible for additional funding or grant,

- A student with criminal convictions will have limited eligibility for federal student aid,

- A student with intellectual disabilities may receive funding from the Pell Grant and other programs.

Conclusion

Filling out the FAFSA is an excellent opportunity to cover at least a part of college costs. Even if you don’t think you’re eligible for financial aid, you should fill out the FAFSA because:

- It discovers if you qualify for other financial assistance like merit-based scholarships, state, and school-based aid, etc.

- There isn’t an official cutoff income to apply,

- The initial numbers aren’t set, and you can appeal for a better offer.

FAFSA will remain useful for minimizing your college cost, which is something a large number of students need.